Finally, you’ll want to decide how all receipts and documents will be stored. You can either keep hard copies or opt for electronic files by scanning paperwork. While any competent employee can handle bookkeeping, accounting is typically handled by a licensed professional.

- Soho’s experienced and professional team offers an extensive range of Bookkeeping Services in Singapore.

- Ask for testimonials from people who have utilized your services in the past and spread the word about your offerings through a website or social media.

- When you engage 3E’s Bookkeeping Services in Singapore, you will be assigned an accountant who will work with you personally on your business accounting needs.

- This information prepared by the bookkeeper is then transferred to the accounts for further processing.

Since taxes are involved, bookkeepers also need to know the relevant requirements of the Inland Revenue Authority of Singapore (IRAS). This initiative helps alleviate the burden on smaller enterprises, enabling them to focus on growth. You are welcome to read our guide on how to incorporate a small company in Singapore. What we like about them is how they’re able to provide their top-notch services at affordable prices yet still meeting all the needs.

Speedy bookkeeping

Ensure that you have chosen an accounting service that will offer you quality services that are within your budget—an important consideration especially for SMEs in need of accounting services. It is widely recommended to outsource bookkeeping activities to a third-party, typically a bookkeeping or accounting firm. Before we delve into why you need to outsource bookkeeping services, we need to briefly paint the picture of what the bookkeeping world basically constitutes. Generally speaking, bookkeeping is the procedure of recording and tracking income and expenses accrued in one’s commercial operations in their business’s books and records. To that end, Singapore companies critically require bookkeeping service providers as such exercises are typically not readily deducible, and somewhat time-consuming. By outsourcing your bookkeeping requirements to companies such as SOHO, which offers tailored bookkeeping solutions attuned to your business needs, you can ensure improved cost efficiency in your company.

- It’s absolutely necessary that the accounting service you are looking to partner with is credible.

- You’ll want to create a contract that outlines details, such as deadlines, rates and expectations so that everyone is on the same page.

- Come filing time, we’ll sort the reports; you just need to click ‘approve’.

- Since the firm specialises in outsourcing, the team works completely off-site.

- Through friend’s referral, I engaged the one stop accounting services from Singapore Accounting to set up my new company.

- Clients can easily track documents and financial statements through a dashboard.

Here are the advantages you will get after hiring Soho to manage accounts. Undoubtedly, both can help your business grow, but there is a slight difference between these two responsibilities. 6 e-commerce financing methods to fuel online growth In cases where you have implemented practices that guarantee the completeness and accuracy of recording all sales receipts, issuing receipts may not be mandatory.

How does accounting work?

Partnering with a trustworthy accounting firm in Singapore that understands the local laws and regulations, while also maintaining a global presence, is a key part of this success. Individuals who are successful bookkeeping professionals are highly organized, can balance ledgers accurately, have an eye for detail and are excellent communicators. The tax rate is progressive and the personal tax management and filing is a consulting service we can offer.

Not only does it require professional expertise, it also needs significant time and effort to be done as well. Striking the right balance between operational and financial efficiency is a struggle for many small businesses in Singapore. While maintaining your own accounting department in-house is a costly affair, outsourcing your accounting services will allow you to save precious time and resources, making it easier to reach your business goals. Bookkeeping services also oversee payrolls, make and maintain monthly financial reports, address tax issues, and handle all company deposits. They additionally evaluate bank statements and attend to all the internal accounts to avert any issues during IRAS audits.

SBS Consulting’ Accounting and Bookkeeping Services Singapore

While many of them provide similar accounting and bookkeeping services, not every firm can boast of experienced managers like DNA Accounting. So, remember to opt for a partner with experience and expertise in auditing, bookkeeping, and taxation. One of the most suitable ways of handling the accounts information is by keeping it online. Soho is using the modern and up to date accounting services with help of software for organizing and updating your accounts records so that you can effortlessly access them anytime. You will get online access to all the financial statements, balance sheets, records, transaction history anytime you need it.

Based on the financial documents we receive from you periodically, your assigned-accountant will also prepare your books and help to draft your financial statements for filling purposes when it is due. We will also set up online system (Xero, Financio) to help you with bookkeeping and accounting. Regardless of the size of your business, it is critical for ongoing success to ensure the accuracy of financial information and use that data to make decisions for the future of your business.

Business Information

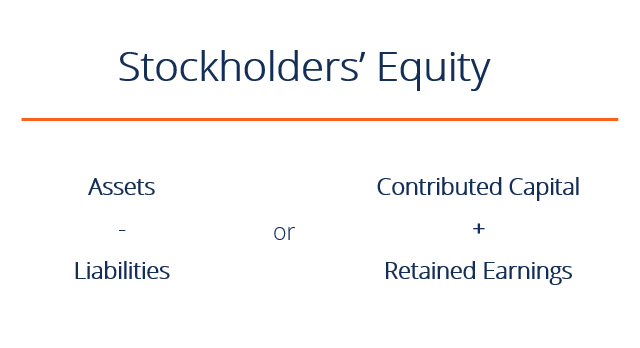

Proper planning and scheduling is key since staying on top of records on a weekly or monthly basis will provide a clear overview of an organization’s financial health. While they seem similar at first glance, bookkeeping and accounting are two very different mediums. Bookkeeping serves as more of a preliminary function through the straightforward recording and organizing of financial information. Accounting takes that information and expands on it through analyzing and interpreting the data. You need to have proper accounting records to compile into a financial statement for submission to meet relevant deadlines set by relevant government agencies.

It also includes more advanced tasks such as the preparation of yearly statements, required quarterly reporting and tax materials. When an effective bookkeeping system is in place, businesses have the knowledge and information that allows them to make the best financial decisions. Tasks, such as establishing a budget, planning for the next fiscal year and preparing for tax time, are easier when financial records are accurate. Transparency and accountability are key factors when it comes to selecting the perfect candidate from a list of bookkeeping service providers in Singapore.

That being said, procuring a professional bookkeeping team’s services ensures that you always know where your money goes, what comes in, and your profit margins. Generally, sound bookkeeping is the best safeguard in case of a tax audit. Without organized records to support one’s income tax assessment, non-income items can be enforced as taxable income, and valid expenses may be excluded from potential tax benefits or deductions. As hinted earlier, some deductible expenses and tax credit opportunities can be overlooked without appropriate bookkeeping when filing income tax returns. Saving organized records of one’s income sources is a fundamental piece of any business. For instance, the business may have money deposited into its company account from different sources and might require a means of proving that some of the deposits are non-business or non-taxable.

Tax accounting services assist firms in navigating Singapore’s complex and ever-changing tax laws and regulations, minimizing tax liabilities. From small businesses to large corporations, we provide personalized tax accounting services suited for your business. Streamlining your accounting services reduces the administrative burden that these critical tasks create. Our professional accounting team removes the labour-intensive duties from your staff, while ensuring compliance and accuracy across all transactions.