Reliable cloud hosting providers employ ransomware-protected and immutable backups for your files to keep them secure from cyber-attacks such as malware, ransomware, phishing, and more. QuickBooks hosted on cloud offers dynamic, contextual security controls designed to protect data in QuickBooks files regardless of where it’s stored—at rest or in transit. Moreover, unified access control recognizes user patterns and behaviors, granting or restricting access based on the context and situation. Cloud Accounting works online giving you access to accounting information from multiple devices anytime, anywhere. While Sage has an option to reimburse employees for gas purchases, there’s no real mileage-tracking feature such as what QuickBooks has with its plans. Depending on which plan you choose with QuickBooks and Sage, you can forecast your cash flow.

Schedule invoices to be sent automatically or send invoices in batches to increase efficiency. Furthermore, QuickBooks learns from such expense categories over a period of time and thus automatically sorts expenses into tax categories. You can even capture your expense receipts which are then automatically matched with your expenses. If you are not switching to cloud-based accounting, you lose on several grounds as a business entity. This means that the multiple copies of your accounting data are backed-up and stored in different servers at various geographical locations. Such redundancy reduces the risk of your information being destroyed completely as a result of fire, natural disaster, crashing of a server, etc.

What you’ve been waiting for is FINALLY here:NEW Hosting plans fit for every firm.

QuickBooks Online Accounting, Wave Accounting and Sage Business Cloud Accounting are three popular solutions. While data and notes are collected and kept on the dashboard, don’t expect QuickBooks Online Accountant to work like a traditional customer relationship management (CRM) software. It is designed to make their accounting a seamless process with your firm, not to track calls and communications. This means that some data may be displayed but not always in the most efficient way.

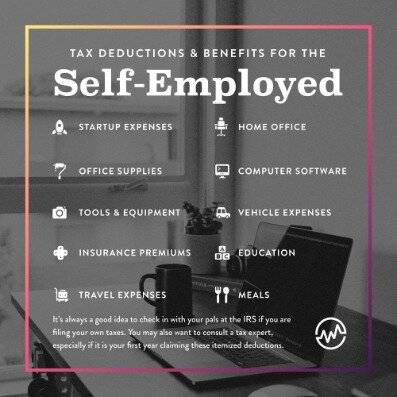

Another outstanding feature is the fact an unlimited number of users can be added. Cloud accounting software offers many benefits for small businesses including saving time, improving productivity and reducing errors by automating time-consuming accounting tasks. It allows small business tax season when you’re self employed vs freelance owners to access their financial data anywhere, anytime and on any device. It ensures data security and prevents data loss by automatically backing up your data in the cloud. It also integrates with business apps you already use, helping you streamline your business operations.

Clarity with custom accounting reports

Furthermore, the data is also prone to viruses, corruption, hacking, and maintenance challenges, it can make you lose your data anytime and could mean loss of time, effort, and money for your business. Whether they work in-house or externally, accountants can use QuickBooks to automate and simplify tedious tasks and gain deep insights to drive growth for your business. If you run your own accounting practice, check out QuickBooks Online Accountant.

- The cash flow statement helps you to know how much money is coming into your business so that you can make your vendor payments accordingly.

- Thus, if you are still dependent on traditional accounting software, it’s time to switch to cloud-based accounting platforms.

- FreshBooks is great for self-employed individuals, sole proprietors and independent contractors.

- It allows one user to create invoices, track payments, accept online card payments and create financial reporting.

- With cloud accounting and the QuickBooks mobile app, you can snap and save photos of your receipts wherever you are.

- It provides features such as a mobile app, invoicing, income tracking, cash flow management, management of 1099 contractors, mileage tracking and app integrations.

Users get unlimited users, invoices, clients, bank accounts and credit connections with each Wave account, making it an excellent choice for businesses looking for cloud accounting software on a budget. Sage is a cloud accounting software that allows small business owners to track their income and expenses in multiple currencies, keep track of inventory and create and manage invoices. This accounting software is suited for solopreneurs, freelancers and micro businesses seeking a platform to track all incoming and outgoing funds.

Why should small businesses in Australia switch to cloud-based accounting software?

Because there is an unlimited number of users that can use the program, you can maximize its use if you have a team of professionals who need access to your accounting software. For Xero’s Early plan ($13), the number of invoices that users can send each month is capped at 20, but for all other Xero plans, users can send unlimited invoices. QuickBooks offers six accounting products, but one of its online accounting plans will be the best choice for most small businesses. Freelancers and independent contractors may opt for simpler options, while larger small businesses might turn to QuickBooks products with advanced inventory, sales and reporting features. While Sage does offer some other cloud accounting software products that are suitable for freelancers and small businesses, Sage Intacct is meant for mid-size businesses. Sage Intacct enhances the general ledger with automation and artificial intelligence (AI) to make it easier to manage accounts receivable and payable.

Cloud accounting software such as QuickBooks is based in the cloud instead of being installed on your desktop computer. Wave is a free accounting service that is designed for small businesses just starting out. The easy-to-use software has all the basic features needed to keep your accounting department in order. Wave’s built-in dashboard makes it easy to quickly access and understand your business’s financial information.

Minimized maintenance and costs

While human error will always play some role in security breaches, you can be confident in your accounting platform when it comes to keeping your information safe. It’s important to note that FreshBooks is the most competitively priced software solution we found. While QuickBooks Online is only 50 cents more than Xero, note that that is the introductory cost for the first three months. QuickBooks Online goes to $30 per month after that and is easily our most expensive option. Today’s leading accounting platforms offer standard security features like data encryption, secure credential tokenization and more.

All of your accounting data was on that now missing laptop, and you can’t even remember the last time you backed that up. When you deploy QuickBooks hosting, you get the digital workflows and trust you need to maximize accounting productivity and collaboration, opening new potential for your QuickBooks operations. Ace Cloud hosted QuickBooks enables your team to deliver essential accounting tasks from any device, anywhere efficiently. It is now easier for customers to pay by debit or credit cards directly from an invoice with low fees starting at just 1.45% + £0.30 per transaction. Cloud / Online accounting is the use of accounting software where both the software and the data is stored online.